Market Overview

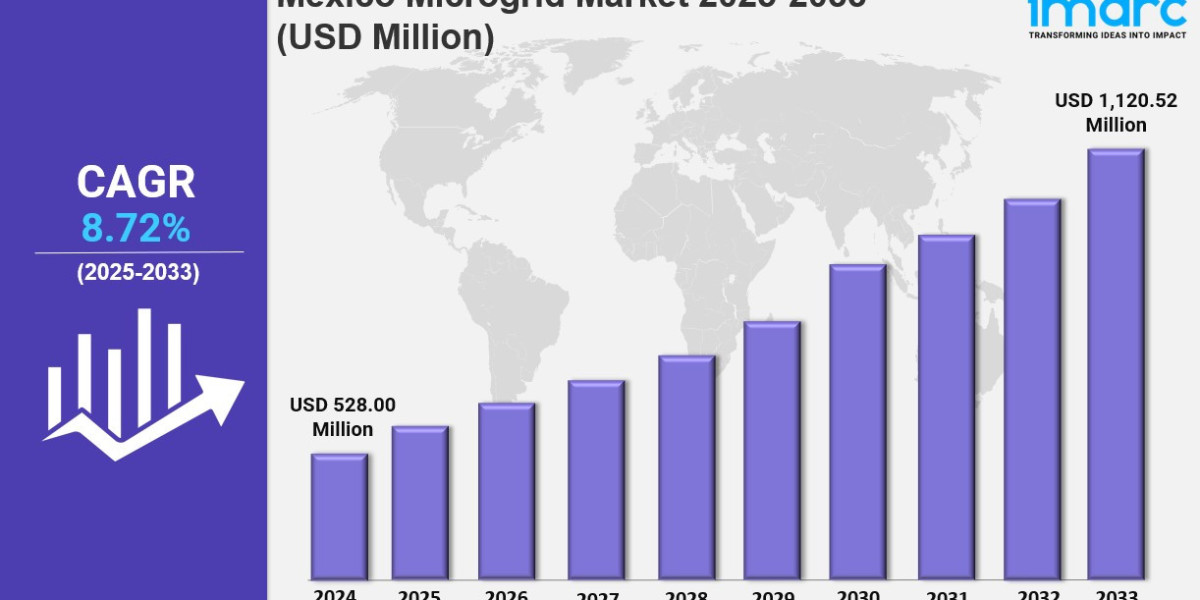

The Mexico microgrid market size reached USD 528.00 Million in 2024. It is expected to reach USD 1,120.52 Million by 2033, growing at a CAGR of 8.72% during 2025-2033. The market growth is driven by rising demand for energy resilience, renewable energy integration, and cost savings. Industrial and commercial sectors are prioritizing microgrids for uninterrupted power supply, complemented by declining technology costs and sustainability goals. Government incentives, unreliable grid infrastructure, and extreme weather events are further expanding the market share.

Study Assumption Years

● Base Year: 2024

● Historical Years: 2019-2024

● Forecast Period: 2025-2033

Mexico Microgrid Market Key Takeaways

● Current Market Size (2024): USD 528.00 Million

● CAGR (2025-2033): 8.72%

● Forecast Period: 2025-2033

● The market is growing due to a rising demand for energy resilience and the integration of renewable energy sources.

● Industrial and commercial sectors prioritize microgrids for reliable, uninterrupted power.

● Declining technology costs and government incentives support market expansion.

● Frequent power outages and extreme weather events increase the need for decentralized energy solutions.

● Businesses adopt hybrid microgrid solutions combining solar PV, wind, and battery storage.

Sample Request Link: https://www.imarcgroup.com/mexico-microgrid-market/requestsample

Market Growth Factors

Renewables: The Mexico microgrid market is market is trending towards renewable energy usage, as Mexico has substantial solar or wind energy generation potential. In 2024, only 25% of the electricity generated in Mexico was from low carbon energy generation sources, compared to a global average of 41%. Solar accounted for 8% of the renewable energy supply. Electricity demand had a 56% growth over 20 years. That growth exceeded clean energy growth in extent, and carbon emissions grew. By 2030, the government targets 33% renewable energy with solar leading. Solar PV, wind, and battery energy storage hybrid microgrids reduce fossil fuel demand with an increase in resilience. The Energy Transition Law and net metering policies encourage renewable microgrids making them financially viable in remote areas and for industry.

Other Markets: The commercial and industrial sector in Mexico increasingly seeks microgrids, especially to manufacture, mine, and house data, to provide energy resilience and avoid that the grid goes out. In 2024, demand rose quickly. This caused power outages in 20 of Mexico's 32 states during a record heat wave. The highest demand reached 44.9 GW against 45 GW of generation capacity in the country. Decentralized microgrids resist more when outages happen and grid infrastructures decay. The increasing frequency of disruptive climate occurrences like droughts causes the decreasing quantity of water from the Cutzamala system to show the potential for microgrids to solve energy and water stress.

Cheaper Technology and Regulations Promote Microgrid Adoption: Microgrids are being adopted with solar and battery storage costs declining, while smart grid technology proliferates. Microgrids are used also to meet mandates and utility sustainability goals. Across the country, government-funded energy modernization programs and private investments in renewable energy and storage are expected to drive the proliferation of microgrids and decentralized energy systems.

Mexico Microgrid Market Segmentation

Energy Source Insights:

● Natural Gas

● Combined Heat and Power

● Solar Photovoltaic (PV)

● Diesel

● Fuel Cell

● Others

This segmentation covers various energy sources used in microgrids, analyzing their contributions to the market.

Application Insights:

● Remote Systems

● Institution and Campus

● Utility/Community

● Defence

● Others

This segmentation reflects the diverse applications of microgrids in remote locations, educational institutions, utilities, defense, and other sectors.

Regional Insights:

● Northern Mexico

● Central Mexico

● Southern Mexico

● Others

Regional analysis includes major geographical markets across Mexico.

Regional Insights

Northern Mexico, Central Mexico, Southern Mexico, and Others constitute the major regional markets. The report does not provide specific market shares or CAGR by region but indicates comprehensive regional market analysis. The growth of microgrid markets in all these regions supports Mexicos goals for energy resilience and renewable integration.

Ask an Analyst: https://www.imarcgroup.com/request?type=reportid=33808flag=C

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302