Market Overview

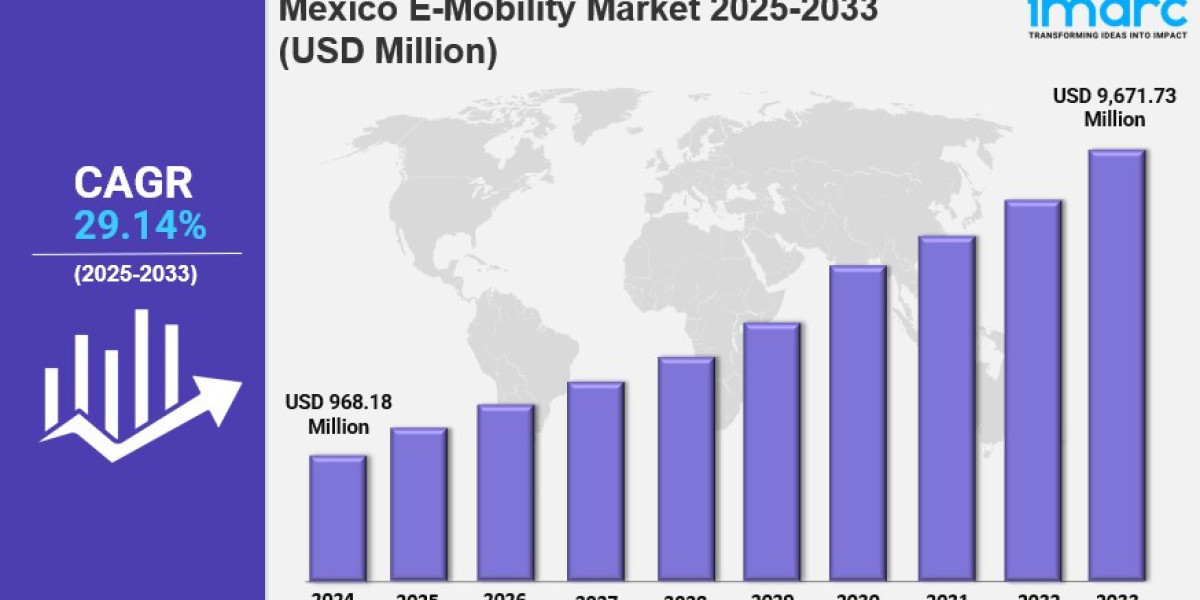

The Mexico e-mobility market size reached USD 968.18 Million in the base year 2024. It is projected to expand robustly to USD 9,671.73 Million by 2033, growing at a CAGR of 29.14% during the forecast period 2025-2033. This growth is driven by an expanding electric transport ecosystem with increasing public electric transit, urban micro-mobility solutions, and smart charging infrastructure development aimed at sustainable and technologically advanced mobility.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

Mexico E-Mobility Market Key Takeaways

● The market size was USD 968.18 Million in 2024.

● The compound annual growth rate (CAGR) is 29.14% for 2025-2033.

● The forecast period spans from 2025 to 2033.

● Mexico is enhancing public transit networks with electric buses and fleets to reduce greenhouse gas emissions and fossil fuel use.

● Urban micro-mobility solutions like electric scooters and e-bikes are increasingly adopted for short-distance travel and last-mile connectivity.

● Investments in smart charging stations have led to installation of over 42,000 charging points by end of 2024.

● Strategic infrastructure investments are helping to promote seamless electric vehicle adoption across urban and intercity locations.

Sample Request Link: https://www.imarcgroup.com/mexico-e-mobility-market/requestsample

Market Growth Factors

In tandem with a broader modernization effort, Mexico’s public transport system is increasingly adopting electric mobility solutions, boosting efficiency and reducing emissions. This transition is a key driver supporting the expansion of Mexico e-mobility market share as cities invest in cleaner, smarter transportation options. Electric buses and operational support vehicles are being deployed in major metropolitan areas to reduce greenhouse gas emissions and use of fossil fuels. The local transit electrification project of energy-efficient corridors, vehicle purchase, and development of high-density bus depots to deploy smart charge-control infrastructure, also forms part of Mexico's climate change commitments, providing safer and more sustainable ways for Mexican citizens to travel and greatly advancing the e-mobility market in the country.

Urban micro-mobility is becoming one of the leading forms of transportation in Mexico, including electric scooters, e-bikes, and light electric vehicles. Micro-mobility offers a solution to the "last mile" challenge transporting individuals with zero emissions from a transit stop toward their final destination. Bicycle lanes and electric vehicle parking as infrastructure support urban micro-mobility adoption. Digital services for real-time vehicle availability and trip planning help increase metropolitan projection. In a report, Mexico's local car brand Olinia is due to roll out production of the EV in Mexico by June 2026, benefiting from local production plants and government policies to reduce traffic congestion, pollution, and improve access to basic services in overcrowded urban centers.

Smart charging systems are essential for support of Mexico's growing EV market. By the end of 2024, more than 42000 charging stations are installed within the country with EV sales increasing 27% year on year. Smart charging systems manage smart energy, monitor remotely, and manage load. These actions can help use electricity efficiently with minimal impact on the electrical grid in times of high demand. Infrastructure for home, workplace, commercial and highway charging is available, meeting a range of urban and inter-city demand. Fast charging stations are locatable in high-traffic areas. They address range anxiety. They build consumer confidence. Adding renewable energy aligns with Mexico's sustainability agenda and supports the sector's growth.

Market Segmentation

Product Insights:

● Electric Car: Personal and commercial electric vehicles designed to reduce carbon emissions.

● Electric Motorcycle: Motorized two-wheelers powered by electric batteries for efficient urban transit.

● Electric Scooter: Compact, low-speed electric vehicles ideal for short trips and urban mobility.

● Electric Bike: Electrically assisted bicycles offering flexible, eco-friendly transportation.

● Others

Voltage Insights:

● Less than 24V: Low-voltage electric mobility devices suitable for micro-mobility.

● 24V: Standard voltage level for various electric two-wheelers and light vehicles.

● 36V: Medium voltage category used in many urban electric mobility products.

● 48V: Higher voltage used for more powerful e-mobility devices.

● Greater than 48V: High-voltage systems enabling longer range and higher performance.

Battery Insights:

● Sealed Lead Acid: Traditional battery technology for electric mobility applications.

● Li-ion: Lithium-ion batteries offering high energy density and longer lifespan.

● NiMH: Nickel Metal Hydride batteries used in select electric vehicle applications.

Regional Insights:

● Northern Mexico: Northern geographic segment with specific market dynamics.

● Central Mexico: Central region contributing significantly to the market.

● Southern Mexico: Southern part of Mexico with evolving e-mobility adoption.

● Others: Additional regions beyond core geographic segmentation.

Regional Insights

Northern Mexico is recognized as the dominant region in the Mexico e-mobility market. The report does not provide specific regional market share or CAGR statistics; however, the strategic investments and infrastructure upgrades across major regions, including Northern Mexico, are noted to drive adoption and growth. The comprehensive development in urban centers supports expansion and uptake of electric mobility solutions broadly.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=35607&flag=C

Recent Developments & News

In September 2024, Didi announced plans to introduce 100,000 electric vehicles in Mexico by 2030 with a $50.3 million investment. The move aims to electrify Didi's app-based transport fleet, reduce emissions by more than 5 million tons, and create the largest electric vehicle fleet in Mexico and Latin America. In February 2024, China's BYD revealed plans to construct a new electric car factory in Mexico, intended as an export base for the U.S. market. The company is conducting feasibility studies and seeking factory locations to boost overseas production beyond China.

Key Players

● Didi

● BYD

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302