Running a retail business means dealing with high volumes of supplier invoices, seasonal order surges, returns, vendor negotiations, taxes, and margin pressures. Keeping the accounts payable (AP) function in-house can become costly, error‑prone, and a bottleneck for growth. Outsourcing AP is increasingly popular among retailers who want to streamline operations, improve cash flow, and focus on core retail functions. This guide explains how to outsource accounts payable for retailers, what benefits and risks to watch, how to pick the right provider, and how to make the transition successful.

What is Outsourced Accounts Payable?

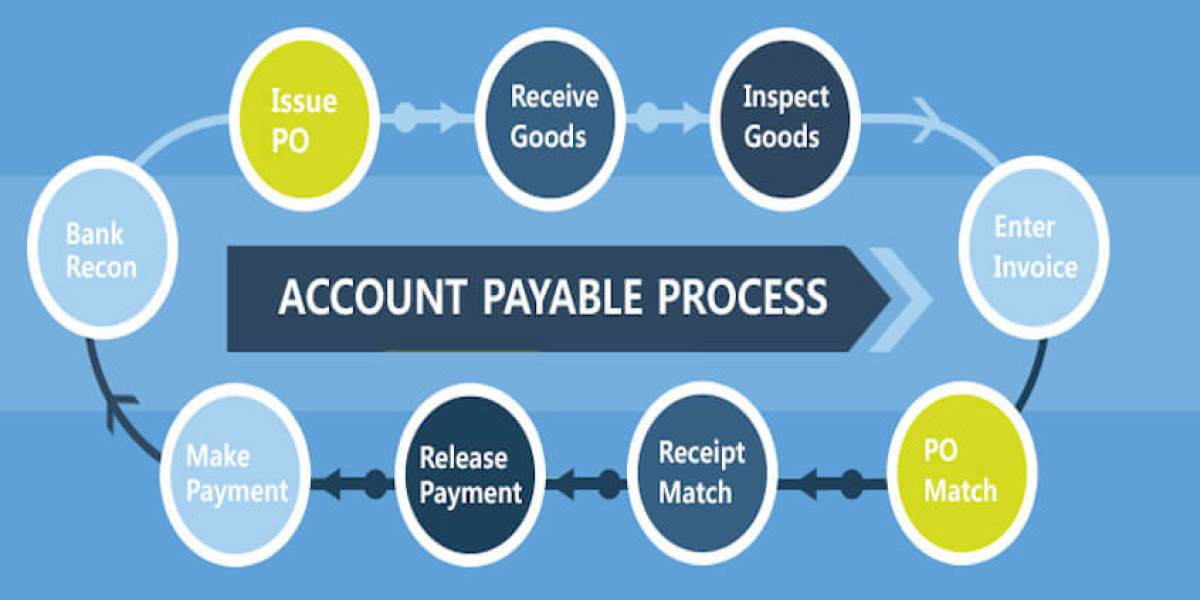

Accounts payable refers to the process of managing all amounts your business owes to vendors/suppliers for goods or services received but not yet paid. Key sub‑tasks typically include:

Receiving and verifying invoices

Matching purchase orders, receipts, and invoices

Managing vendor statements and resolving discrepancies

Scheduling payments (making sure they are timely to avoid late fees or take early payment discounts)

Maintaining records for audits / statutory / tax compliance

Vendor communication and reconciliation

When you outsource AP, those tasks are managed (in whole or part) by an external service provider rather than your internal finance team. The provider may use cloud software, automation, dashboards, workflow tools, and specialists to do this more efficiently.

Why Retailers Outsource AP: Key Benefits

Here are the main advantages for retailers:

Cost Savings

Hiring, training, and retaining an internal AP staff, along with software licenses, systems, and infrastructure, incurs fixed overheads. Outsourcing turns many of these into variable costs and often lowers per‑invoice processing costs.Improved Accuracy & Fewer Errors

Manual invoice entry, duplicate invoices, wrong amounts, missed due dates—all are more likely when handling AP in‑house with heavy volumes. Outsourced providers often use automation, verification systems, and specialized staff to reduce these errors.Faster Processing and Cash Flow Visibility

Retailers often have to juggle inventory, shelf turnover, vendor terms, and seasonal spikes. Outsourced AP can accelerate invoice approval workflows, compress cycle times, and provide real‑time dashboards showing unpaid invoices, due dates, vendor liabilities, and predicted cash outflows.Scalability & Flexibility

Retailers experience volume spikes—holiday seasons, promotions, clearance sales—and fluctuations in vendor activity. Outsourced AP services let you scale up or down capacity without hiring temp staff or overburdening accounting teams.Better Vendor Relationships & Terms

Timely, accurate payments build trust with suppliers. When retailers miss deadlines or cause delays due to internal backlogs, vendor relationships suffer. Outsourcing can ensure payments are made on time, which may also help you negotiate better pricing or early payment discounts.Access to Technology & Best Practices

Providers of AP outsourcing usually invest in state‑of‑the‑art tools—automation, cloud‑based ERP integration, AI or machine learning for anomaly detection, fraud detection, improved matching of POs/receipts/invoices. Retailers benefit without having to build or maintain those systems themselves.Risk Mitigation, Compliance, Fraud Reduction

External AP partners often implement stricter controls—multi‑level approvals, audit trails, duplicate invoice detection, fraud prevention, compliance with tax and statutory requirements. This can reduce financial leakage and regulatory risk.

Potential Challenges and Risks

While there are many upsides, outsourcing AP comes with trade‑offs. Retailers should be aware of these:

Loss of Control or Oversight: When handing over AP, you may lose some direct oversight of processes. If key vendors or unusual/infrequent transactions need special handling, there could be communication lags or misunderstandings.

Data Security & Privacy: Sensitive financial data is being handled externally, so security, confidentiality, compliance with local laws (especially tax, vendor privacy, etc.) must be ensured.

Hidden Costs or Service Levels: Some outsourcing providers might have charges for additional services (custom reports, rush payments, etc.), or may not meet service level expectations. Ensure contracts clearly define performance metrics.

Vendor and Provider Fit: If the outsourcing provider doesn’t understand retail – e.g. multi‑location stores, returns, promotions, credit terms with suppliers – then their systems/ workflows might not suit your needs well.

How to Choose the Right AP Outsourcing Provider

To get full value, retailers should evaluate potential providers along several dimensions:

Industry Experience & Retail‑Specific Expertise

Check if the provider has worked with retailers and understands retail‑specific challenges: returns, credits, seasonality, vendor terms, POS integrations, etc.Technology & Automation Capabilities

Does the provider use tools that integrate with your ERP or accounting system? Do they have automation for invoice scanning, PO/receipt matching, alerts, dashboards, analytics? The more automated, the less manual work and fewer errors.Scalability & Flexibility

You’ll want a partner who can handle your busiest seasons; who can increase capacity when needed without hugely increasing cost or delaying workflows.Security, Compliance, and Audit Readiness

Ensure the provider follows data security best practices, has good controls, maintains records for audit / statutory compliance, understands tax, vendor documentation, local laws. Contractual commitments on confidentiality and data handling matter.Service‑Level Agreements (SLAs) & KPIs

Define metrics: invoice turnaround time, error rate, percentage of invoices processed automatically, vendor payment timing, discounts captured, etc. Having transparent reporting is key.Cost Structure & Transparency

Make sure you understand how the provider charges (per invoice, by volume tiers, fixed monthly fee, extra fees for rush or exceptions). Also estimate potential savings vs what you're currently spending.Cultural Fit & Communication

If the provider is offshore or in another country/time zone, cultural fit, language fluency, and systems for communication should be strong so nothing gets missed.

Best Practices for Implementing Outsourced AP in Retail

Once you’ve chosen a provider, success depends on good implementation. Here are best practices:

Map & Document Existing AP Workflow

Before transition, map all steps: invoice receipt, purchase orders, receipts, approvals, payments, vendor statements, returns or credit memos. Understand where you currently have bottlenecks or errors.Set Up a Pilot / Phased Rollout

Start with a subset: maybe one region, a subset of vendors, or lower volume categories. Measure performance, gather feedback, refine before full rollout.Clear Onboarding & Training

Ensure vendors know how to send invoices (format, PO numbers, etc.), employees understand what exceptions look like, approval workflows are clearly defined, and your internal team knows their roles post‑outsourcing.Integration with Your Systems

Make sure the outsourcing partner integrates with your accounting / ERP / vendor management systems. Automate as much as possible: vendor invoices, PO matching, payment scheduling, bank reconciliation.Communication Protocols & Vendor Management

Define how vendor queries or disputes are handled, who escalates, how vendor relationships are maintained. Since retailers heavily depend on supplier chain, smooth vendor communication is critical.Monitoring and Continuous Improvement

Regularly track KPIs: days payable outstanding (DPO), invoice processing lead time, number of errors, late payments, discount opportunities captured. Use dashboards & reports to spot lagging areas and improve with provider.Risk / Compliance Checks

Regular audits, data security reviews, ensuring the provider is adhering to agreed SLAs, following tax, legal, vendor documentation and maintaining records for statutory compliance.

Conclusion

For retailers, outsourcing accounts payable isn’t just a cost‑cutting move—it’s a strategic decision. When done properly, it delivers faster invoice processing, better vendor relationships, improved cash flow, reduced errors, and allows your finance team to focus on higher value work like vendor negotiation, financial planning, growth strategies. But the gains come only when you pick the right provider, structure the agreement well, and implement with care—mapping workflows, defining KPIs, maintaining communication, and keeping a close eye on compliance and risk.